A living trust—also known as an inter vivos trust—is a legal tool that allows you to transfer ownership of your assets into a trust during your lifetime. The trust is managed by a trustee and designed to benefit one or more people, known as beneficiaries. This estate planning strategy offers flexibility, privacy, and the potential to avoid probate.

Let’s explore what a living trust is, how it works, and whether it’s right for you or your loved ones.

What Is a Living Trust?

A living trust is a legal document that outlines how your assets should be managed and distributed—both while you’re alive and after you pass away. When you create a living trust, you transfer ownership of assets like your home, financial accounts, or personal property into the trust.

You can act as the trustee and manage the assets yourself, or name someone else to do so. After your death (or if you become incapacitated), a successor trustee steps in to manage or distribute the assets according to your wishes.

Types of Living Trusts

Living trusts generally fall into two categories:

- Revocable Living Trust: You can change or revoke the trust at any time during your life. This is the most common type for estate planning.

- Irrevocable Living Trust: Once established, you cannot modify or cancel the trust. These are often used to reduce estate taxes or protect assets from creditors.

Specialized living trusts include:

- Discretionary Trust: The trustee has flexibility in how and when assets are distributed.

- Spendthrift Trust: Protects the trust’s assets from being misused by a financially irresponsible beneficiary.

- Special Needs Trust: Benefits a nonprofit or cause rather than an individual.

- Charitable Trust: Benefits a nonprofit or cause rather than an individual.

Who Uses Living Trusts?

Living trusts are commonly used by individuals or families who:

- Want to avoid probate and speed up asset distribution

- Have complex family dynamics or blended families

- Wish to manage how and when a beneficiary receives an inheritance

- Have privacy concerns and prefer not to make estate details public

- Want to protect assets from creditors or taxes

How Does a Living Trust Work?

Here’s a simplified overview:

- You (the grantor) create the trust document and decide which assets to include.

- You or someone you trust is named as the trustee to manage the assets.

- Beneficiaries are named to receive the assets either during your lifetime or after your death.

- A successor trustee is named to step in upon your incapacity or death.

The trust becomes operational immediately and can continue functioning without court involvement if something happens to you.

Benefits of a Living Trust

- Avoids Probate: Assets in a trust can bypass the probate court process, allowing faster and more private distribution.

- Maintains Privacy: Wills become public record; trusts remain private.

- Allows Incapacity Planning: Your trustee can step in without needing a court-appointed guardian.

- Flexibility and Control: You set the terms—when and how assets are used.

- Potential Tax Benefits: In certain cases, irrevocable trusts can help reduce estate taxes.

Drawbacks to Consider

- Cost: Creating a trust typically costs more than a will, ranging from $1,000 to $3,000 or more depending on complexity.

- Ongoing Administration: Trusts require regular updates and maintenance.

- No automatic Asset Protection: Revocable trusts don’t protect assets from creditors or lawsuits unless made irrevocable.

How Much Does It Cost?

The cost of setting up and administering a living trust varies:

- Basic Trust Setup: $1,000–$2,500 (with an attorney)

- Online Services: $200–$700 (for simpler estates)

- Complex or Irrevocable Trusts: $3,000+ (often includes tax planning or asset protection)

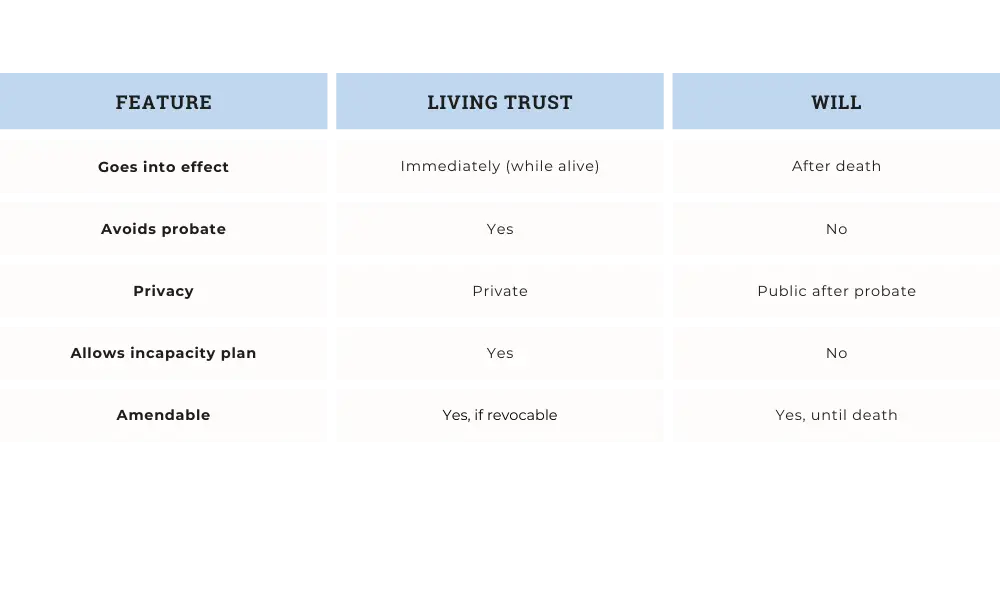

Living Trust vs. Will: What’s the Difference?

You can (and often should) have both a will and a trust. The trust handles specific assets, while the will handles the rest of your estate.

Alternatives to a Living Trust

If a living trust doesn’t suit your needs, other options include:

- Last Will and Testament: A basic legal document for passing on your assets.

- Payable-on-Death Accounts: Transfer financial accounts directly to a beneficiary.

- Gifting: Give assets outright during your lifetime.

- Joint Ownership: Property passes to the surviving owner automatically.

Final Thoughts: Is a Living Trust Right for You?

A living trust offers many advantages for families who want control, privacy, and efficiency when transferring assets. However, it’s not the best fit for everyone. Trusts require careful planning, and the costs may outweigh the benefits for some.

If you’re unsure where to start, consider speaking with an estate planning attorney or using a trusted online service that specializes in living trusts.