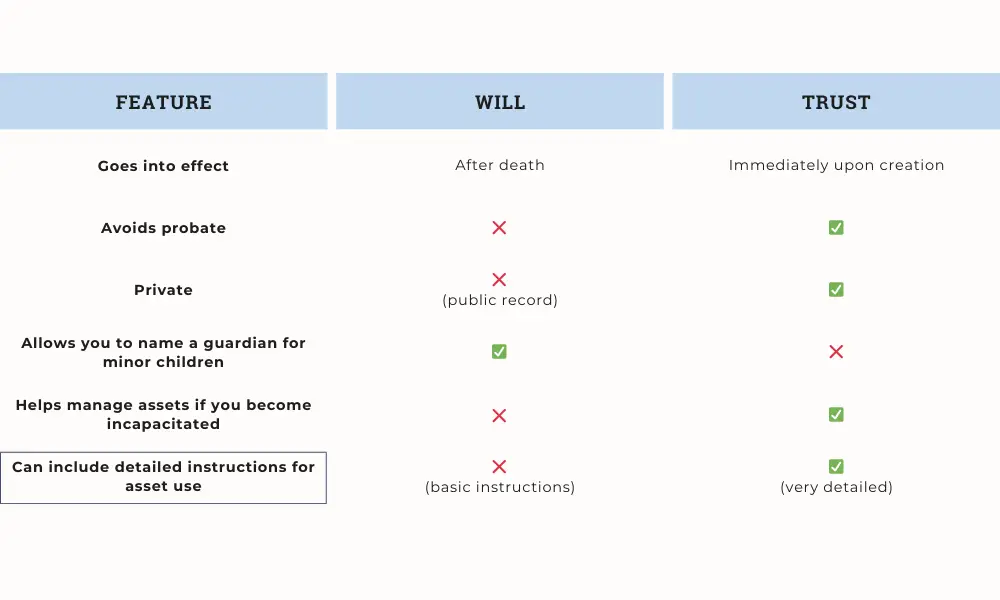

When it comes to planning your estate, wills and trusts are two of the most commonly used tools—but they’re often misunderstood. While they both help you distribute your assets after you pass away, they serve different purposes and offer different advantages. Understanding how each works is key to creating a thoughtful estate plan that meets your goals and protects your loved ones.

What is a Trust?

A trust is a legal arrangement that allows someone (the “grantor”) to transfer ownership of assets to another party (the “trustee”) who manages those assets for the benefit of one or more individuals (the “beneficiaries”). Trusts are flexible tools that can be customized for a variety of purposes, such as supporting children, avoiding probate, or minimizing taxes.

Types of Trusts

- Revocable (Living) Trust

Created during the grantor’s lifetime, revocable trusts can be modified or revoked at any time. They allow you to maintain control over your assets while setting up clear instructions for how they should be used if you become incapacitated or pass away. - Irrevocable Trusts

These trusts cannot be changed once created. They are often used for tax planning or asset protection, since the assets are no longer considered part of your estate.

- Testamentary Trusts

Created through a will, these trusts go into effect only after your death. Unlike revocable trusts, testamentary trusts don’t avoid probate and are subject to court oversight.

Key Roles in a Trust

- Grantor: The person who creates and funds a trust.

- Trustee: The person or institution that manages the trust assets.

- Beneficiaries: The individuals or organizations who receive the benefits from the trust.

Trusts are often used to manage wealth across generations, provide for loved ones with special needs, or maintain privacy and control over how assets are used.

What is a Will?

A will, or last will and testament, is a legal document that outlines your wishes for how your property should be distributed after your death. It also allows you to name guardians for minor children, specify funeral arrangements, and appoint an executor to manage your estate.

Unlike a trust, a will must go through probate—a court-supervised process for validating the will and distributing assets. Wills are also public record, which means anyone can access them after your death.

How to Create a Will

You can create a will using:

- Online will-making Tools: A budget-friendly option for simple estates.

- An estate planning attorney: Ideal for more complex estates or when you want personalized advice.

Whatever method you choose, make sure your will complies with your state’s legal requirements (such as witness signatures) to ensure it’s valid.

Do You Need Both a Will and a Trust?

In many cases, yes.

A trust helps you avoid probate, maintain privacy, and control how your assets are used after your death. It’s especially useful if you:

- Own significant assets

- Have minor children

- Want to support a loved one with special needs

- Have been remarried or have a blended family

- Want to avoid making your estate public

However, even if you have a trust, you still need a “pour-over” will to handle any assets you didn’t transfer into your trust during your lifetime. A will is also necessary to name guardians for minor children, which a trust cannot do.

If your financial situation is simple—for example, if you’re young, single, and don’t own much property—you may only need a basic will. But as your life and assets grow, a trust can add an extra layer of protection and control.

The Benefits of Using Wills and Trusts Together

Here’s how combining both tools can strengthen your estate plan:

Final Thoughts: Making the Right Choice for You

Wills and trusts are not either/or tools—they work best together. A trust can simplify asset distribution and provide privacy, while a will ensures any loose ends are tied up and your final wishes are honored.

If you’re unsure which tools are right for your situation, it’s always wise to speak with an estate planning attorney. They can help you craft a plan that fits your needs and brings peace of mind for you and your loved ones.